Einhorn Company has fixed costs of $105,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company’s two products are provided below.

Product Selling Price Variable Cost per Unit Contribution Margin per Unit

QQ $50 $35 $15

ZZ 60 30 30

The sales mix for products QQ and ZZ is 40% and 60%, respectively. Determine the break-even point in units of QQ and ZZ.

Answer:

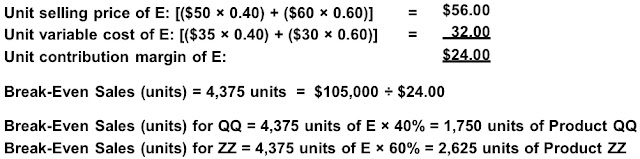

Unit selling price of E: [($50 × 0.40) + ($60 × 0.60)] = $56.00

Unit variable cost of E: [($35 × 0.40) + ($30 × 0.60)] = 32.00

Unit contribution margin of E: $24.00

Break-Even Sales (units) = 4,375 units = $105,000 ÷ $24.00

Break-Even Sales (units) for QQ = 4,375 units of E × 40% = 1,750 units of Product QQ

Break-Even Sales (units) for ZZ = 4,375 units of E × 60% = 2,625 units of Product ZZ