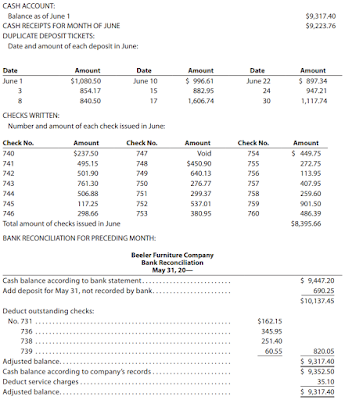

CASH ACCOUNT:

Balance as of June 1 $9,317.40

CASH RECEIPTS FOR MONTH OF JUNE $9,223.76

DUPLICATE DEPOSIT TICKETS:

Date and amount of each deposit in June:

Date Amount Date Amount Date Amount

June 1 $1,080.50 June 10 $ 996.61 June 22 $ 897.34

3 854.17 15 882.95 24 947.21

8 840.50 17 1,606.74 30 1,117.74

CHECKS WRITTEN:

Number and amount of each check issued in June:

Check No. Amount Check No. Amount Check No. Amount

740 $237.50 747 Void 754 $ 449.75

741 495.15 748 $450.90 755 272.75

742 501.90 749 640.13 756 113.95

743 761.30 750 276.77 757 407.95

744 506.88 751 299.37 758 259.60

745 117.25 752 537.01 759 901.50

746 298.66 753 380.95 760 486.39

Total amount of checks issued in June $8,395.66

BANK RECONCILIATION FOR PRECEDING MONTH:

Beeler Furniture Company

Bank Reconciliation

May 31, 20—

Cash balance according to bank statement . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,447.20

Add deposit for May 31, not recorded by bank . . . . . . . . . . . . . . . . . . . . . . . 690.25

$10,137.45

Deduct outstanding checks:

No. 731 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $162.15

736 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 345.95

738 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 251.40

739 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60.55 820.05

Adjusted balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,317.40

Cash balance according to company’s records . . . . . . . . . . . . . . . . . . . . . . . $ 9,352.50

Deduct service charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.10

Adjusted balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,317.40

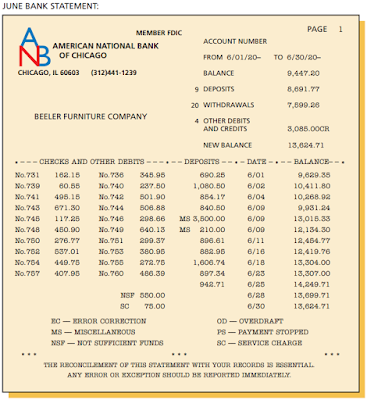

JUNE BANK STATEMENT

AMERICAN NATIONAL BANK

OF CHICAGO

CHICAGO, IL 60603 (312)441-1239

MEMBER FDIC

ACCOUNT NUMBER

FROM 6/01/20– TO 6/30/20–

BALANCE 9,447.20

DEPOSITS 8,691.77

WITHDRAWALS 7,599.26

OTHER DEBITS

AND CREDITS 3,085.00CR

NEW BALANCE 13,624.71

9

20

4 BEELER FURNITURE COMPANY

* – – – CHECKS AND OTHER DEBITS – – – * – – DEPOSITS – – * – DATE – * – – BALANCE– – *

No.731 162.15 No.736 345.95 690.25 6/01 9,629.35

No.739 60.55 No.740 237.50 1,080.50 6/02 10,411.80

No.741 495.15 No.742 501.90 854.17 6/04 10,268.92

No.743 671.30 No.744 506.88 840.50 6/09 9,931.24

No.745 117.25 No.746 298.66 MS 3,500.00 6/09 13,015.33

No.748 450.90 No.749 640.13 MS 210.00 6/09 12,134.30

No.750 276.77 No.751 299.37 896.61 6/11 12,454.77

No.752 537.01 No.753 380.95 882.95 6/16 12,419.76

No.754 449.75 No.755 272.75 1,606.74 6/18 13,304.00

No.757 407.95 No.760 486.39 897.34 6/23 13,307.00

942.71 6/25 14,249.71

NSF 550.00 6/28 13,699.71

SC 75.00 6/30 13,624.71

EC –– ERROR CORRECTION OD –– OVERDRAFT

MS –– MISCELLANEOUS PS –– PAYMENT STOPPED

NSF –– NOT SUFFICIENT FUNDS SC –– SERVICE CHARGE

* * * * * * * * *

THE RECONCILEMENT OF THIS STATEMENT WITH YOUR RECORDS IS ESSENTIAL.

ANY ERROR OR EXCEPTION SHOULD BE REPORTED IMMEDIATELY.

J

Instructions

1. Prepare a bank reconciliation as of June 30. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable.

2. Journalize the necessary entries. The accounts have not been closed.

3. What is the amount of Cash that should appear on the balance sheet as of June 30?

4. Assume that a canceled check for $390 has been incorrectly recorded by the bank as $930. Briefly explain how the error would be included in a bank reconciliation and how it should be corrected.

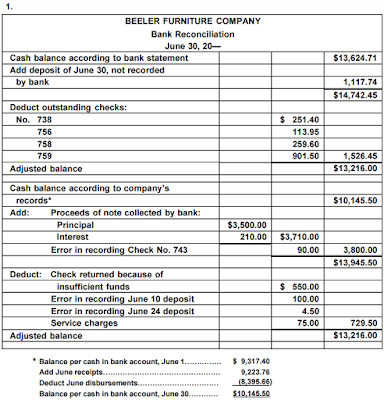

Answers:

1.

BEELER FURNITURE COMPANY

Bank Reconciliation

June 30, 20—

Cash balance according to bank statement $13,624.71

Add deposit of June 30, not recorded

by bank 1,117.74

$14,742.45

Deduct outstanding checks:

No. 738 $ 251.40

756 113.95

758 259.60

759 901.50 1,526.45

Adjusted balance $13,216.00

Cash balance according to company’s

records* $10,145.50

Add: Proceeds of note collected by bank:

Principal $3,500.00

Interest 210.00 $3,710.00

Error in recording Check No. 743 90.00 3,800.00

$13,945.50

Deduct: Check returned because of

insufficient funds $ 550.00

Error in recording June 10 deposit 100.00

Error in recording June 24 deposit 4.50

Service charges 75.00 729.50

Adjusted balance $13,216.00

* Balance per cash in bank account, June 1…………… $ 9,317.40

Add June receipts………………………………………… 9,223.76

Deduct June disbursements…………………………… (8,395.66)

Balance per cash in bank account, June 30………… $10,145.50

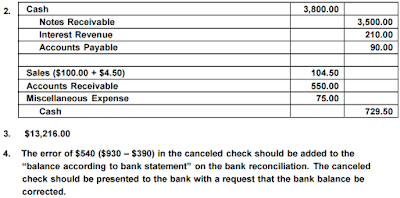

2.

Cash 3,800.00

Notes Receivable 3,500.00

Interest Revenue 210.00

Accounts Payable 90.00

Sales ($100.00 + $4.50) 104.50

Accounts Receivable 550.00

Miscellaneous Expense 75.00

Cash 729.50

3. $13,216.00

4. The error of $540 ($930 – $390) in the canceled check should be added to the

“balance according to bank statement” on the bank reconciliation. The canceled

check should be presented to the bank with a request that the bank balance be

corrected.