a. Checks outstanding totaled $17,865.

b. A deposit of $9,150, representing receipts of July 31, had been made too late to appear on the bank statement.

c. The bank had collected $6,095 on a note left for collection. The face of the note was $5,750.

d. A check for $390 returned with the statement had been incorrectly recorded by Stone Systems as $930. The check was for the payment of an obligation to Holland Co. for the purchase of office supplies on account.

e. A check drawn for $1,810 had been incorrectly charged by the bank as $1,180.

f. Bank service charges for July amounted to $80.

Instructions

1. Prepare a bank reconciliation.

2. Journalize the necessary entries. The accounts have not been closed.

3. If a balance sheet were prepared for Stone Systems on July 31, 2014, what amount should be reported as cash?

Answers:

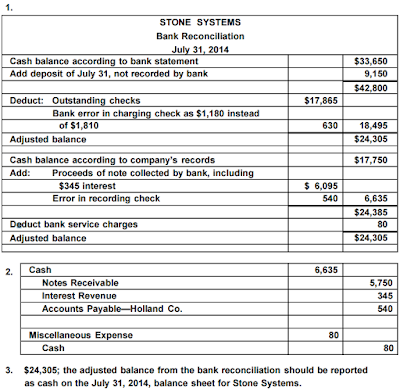

1.

STONE SYSTEMS

Bank Reconciliation

July 31, 2014

Cash balance according to bank statement $33,650

Add deposit of July 31, not recorded by bank 9,150

$42,800

Deduct: Outstanding checks $17,865

Bank error in charging check as $1,180 instead

of $1,810 630 18,495

Adjusted balance $24,305

Cash balance according to company’s records $17,750

Add: Proceeds of note collected by bank, including

$345 interest $ 6,095

Error in recording check 540 6,635

$24,385

Deduct bank service charges 80

Adjusted balance $24,305

2.

Cash 6,635

Notes Receivable 5,750

Interest Revenue 345

Accounts Payable—Holland Co. 540

Miscellaneous Expense 80

Cash 80

3. $24,305; the adjusted balance from the bank reconciliation should be reported

as cash on the July 31, 2014, balance sheet for Stone Systems.