Jan. 18. Issued Invoice No. 1 to Murphy Co. for $490 on account.

20. Issued Invoice No. 2 to Qwik-Mart Co. for $340 on account.

24. Issued Invoice No. 3 to Hopkins Co. for $750 on account.

27. Issued Invoice No. 4 to Carson Co. for $680 on account.

28. Issued Invoice No. 5 to Amber Waves Co. for $120 on account.

28. Provided security services, $100, to Qwik-Mart Co. in exchange for supplies.

30. Issued Invoice No. 6 to Qwik-Mart Co. for $200 on account.

31. Issued Invoice No. 7 to Hopkins Co. for $295 on account.

Instructions

1. Journalize the transactions for January, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: Amber Waves Co.; Carson Co.; Hopkins Co.; Murphy Co.; Qwik-Mart Co.

2. Post the revenue journal to the following accounts in the general ledger, inserting the account balances only after the last postings:

12 Accounts Receivable

14 Supplies

41 Fees Earned

3.

a. What is the sum of the balances of the customer accounts in the subsidiary ledger at January 31?

b. What is the balance of the accounts receivable controlling account at January 31?

4. Assume Guardian Security Services began using a computerized accounting system to record the sales transactions on February 1. What are some of the benefits of the computerized system over the manual system?

Answer:

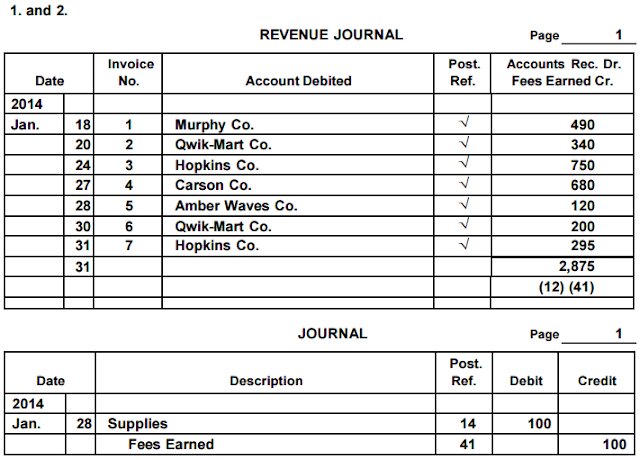

1. and 2.

REVENUE JOURNAL Page 1

Date

Invoice

No. Account Debited

Post.

Ref.

Accounts Rec. Dr.

Fees Earned Cr.

2014

Jan. 18 1 Murphy Co. √ 490

20 2 Qwik-Mart Co. √ 340

24 3 Hopkins Co. √ 750

27 4 Carson Co. √ 680

28 5 Amber Waves Co. √ 120

30 6 Qwik-Mart Co. √ 200

31 7 Hopkins Co. √ 295

31 2,875

(12) (41)

JOURNAL Page 1

Date Description

Post.

Ref. Debit Credit

2014

Jan. 28 Supplies 14 100

Fees Earned 41 100

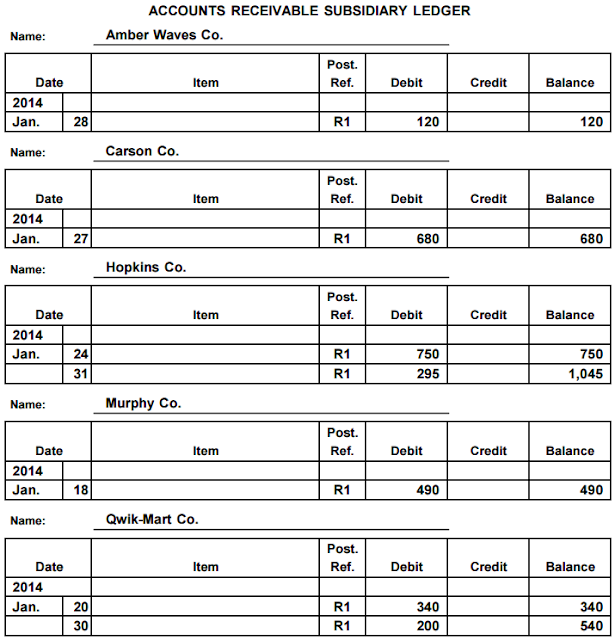

ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER

Name: Amber Waves Co.

Date Item

Post.

Ref. Debit Credit Balance

2014

Jan. 28 R1 120 120

Name: Carson Co.

Date Item

Post.

Ref. Debit Credit Balance

2014

Jan. 27 R1 680 680

Name: Hopkins Co.

Date Item

Post.

Ref. Debit Credit Balance

2014

Jan. 24 R1 750 750

31 R1 295 1,045

Name: Murphy Co.

Date Item

Post.

Ref. Debit Credit Balance

2014

Jan. 18 R1 490 490

Name: Qwik-Mart Co.

Date Item

Post.

Ref. Debit Credit Balance

2014

Jan. 20 R1 340 340

30 R1 200 540

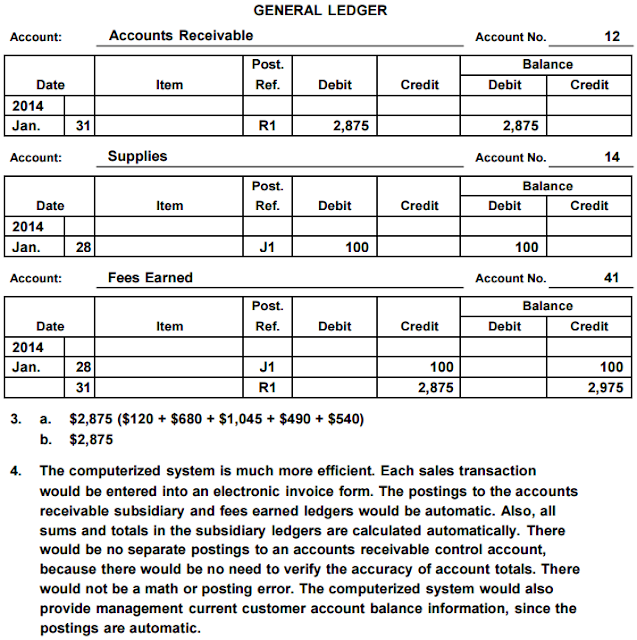

GENERAL LEDGER

Account: Accounts Receivable Account No. 12

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 R1 2,875 2,875

Account: Supplies Account No. 14

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 28 J1 100 100

Account: Fees Earned Account No. 41

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 28 J1 100 100

31 R1 2,875 2,975

3. a. $2,875 ($120 + $680 + $1,045 + $490 + $540)

b. $2,875

4. The computerized system is much more efficient. Each sales transaction

would be entered into an electronic invoice form. The postings to the accounts

receivable subsidiary and fees earned ledgers would be automatic. Also, all

sums and totals in the subsidiary ledgers are calculated automatically. There

would be no separate postings to an accounts receivable control account,

because there would be no need to verify the accuracy of account totals. There

would not be a math or posting error. The computerized system would also

provide management current customer account balance information, since the

postings are automatic.