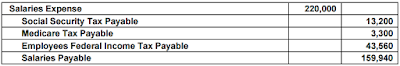

The payroll register of Konrath Co. indicates $13,200 of social security withheld and $3,300 of Medicare tax withheld on total salaries of $220,000 for the period. Federal withholding for the period totaled $43,560. Provide the journal entry for the period’s payroll.

Answer:

Salaries Expense 220,000

Social Security Tax Payable 13,200

Medicare Tax Payable 3,300

Employees Federal Income Tax Payable 43,560

Salaries Payable 159,940

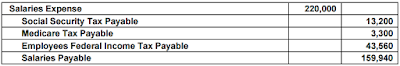

Salaries Expense 220,000

Social Security Tax Payable 13,200

Medicare Tax Payable 3,300

Employees Federal Income Tax Payable 43,560

Salaries Payable 159,940