Answer:

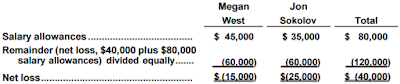

Megan Jon

West Sokolov Total

Salary allowances ...................................... $ 45,000 $ 35,000 $ 80,000

Remainder (net loss, $40,000 plus $80,000

salary allowances) divided equally....... (60,000) (60,000) (120,000)

Net loss....................................................... $ (15,000) $(25,000) $ (40,000)