May Cheng and Hannah Webster are partners who share in the income equally and have capital balances of $207,000 and $62,500, respectively. Cheng, with the consent of Webster, sells one-third of her interest to Michael Cross. What entry is required by the partnership if the sales price is (a) $60,000? (b) $80,000?

Answer:

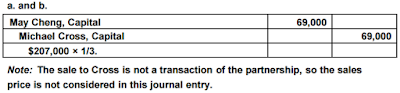

a. and b.

May Cheng, Capital 69,000

Michael Cross, Capital 69,000

$207,000 × 1/3.

Note: The sale to Cross is not a transaction of the partnership, so the sales

price is not considered in this journal entry.

a. and b.

May Cheng, Capital 69,000

Michael Cross, Capital 69,000

$207,000 × 1/3.

Note: The sale to Cross is not a transaction of the partnership, so the sales

price is not considered in this journal entry.