Instructions

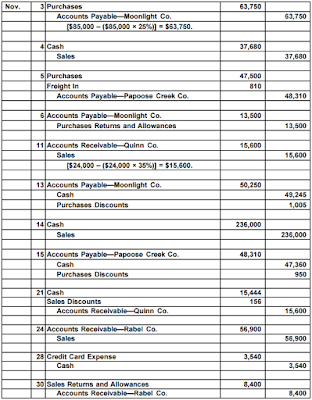

Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory system.

Answer:

Nov. 3 Purchases 63,750

Accounts Payable—Moonlight Co. 63,750

[$85,000 – ($85,000 × 25%)] = $63,750.

4 Cash 37,680

Sales 37,680

5 Purchases 47,500

Freight In 810

Accounts Payable—Papoose Creek Co. 48,310

6 Accounts Payable—Moonlight Co. 13,500

Purchases Returns and Allowances 13,500

11 Accounts Receivable—Quinn Co. 15,600

Sales 15,600

[$24,000 – ($24,000 × 35%)] = $15,600.

13 Accounts Payable—Moonlight Co. 50,250

Cash 49,245

Purchases Discounts 1,005

14 Cash 236,000

Sales 236,000

15 Accounts Payable—Papoose Creek Co. 48,310

Cash 47,360

Purchases Discounts 950

21 Cash 15,444

Sales Discounts 156

Accounts Receivable—Quinn Co. 15,600

24 Accounts Receivable—Rabel Co. 56,900

Sales 56,900

28 Credit Card Expense 3,540

Cash 3,540

30 Sales Returns and Allowances 8,400

Accounts Receivable—Rabel Co. 8,400