Recessive Interiors

Unadjusted Trial Balance

January 31, 2014

Debit

Balances

Credit

Balances

11 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,100

13 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,000

14 Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,500

16 Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113,000

17 Accumulated Depreciation—Equipment . . . . . . . . . . . . . . . . . . . . . . . . 12,000

18 Trucks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90,000

19 Accumulated Depreciation—Trucks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,100

21 Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,500

31 Jeanne McQuay, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 126,400

32 Jeanne McQuay, Drawing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,000

41 Service Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 155,000

51 Wages Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,000

52 Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,600

53 Truck Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,350

59 Miscellaneous Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,450

325,000 325,000

The data needed to determine year-end adjustments are as follows:

a. Supplies on hand at January 31 are $2,850.

b. Insurance premiums expired during the year are $3,150.

c. Depreciation of equipment during the year is $5,250.

d. Depreciation of trucks during the year is $4,000.

e. Wages accrued but not paid at January 31 are $900.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.

2. (Optional.) Enter the unadjusted trial balance on an end-of-period spreadsheet (work sheet) and complete the spreadsheet. Add the accounts listed in part (3) as needed.

3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors’ chart of accounts should be used: Wages Payable, 22; Depreciation Expense—Equipment, 54; Supplies Expense, 55; Depreciation Expense— Trucks, 56; Insurance Expense, 57.

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner’s equity (no additional investments were made during the year), and a balance sheet.

6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry.

7. Prepare a post-closing trial balance.

Answer:

1., 3., and 6.

Account: Cash Account No. 11

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 13,100

Account: Supplies Account No. 13

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 8,000

31 Adjusting 26 5,150 2,850

Account: Prepaid Insurance Account No. 14

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 7,500

31 Adjusting 26 3,150 4,350

Account: Equipment Account No. 16

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 113,000

Account: Accumulated Depreciation—Equipment Account No. 17

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 12,000

31 Adjusting 26 5,250 17,250

Account: Trucks Account No. 18

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 90,000

Account: Accumulated Depreciation—Trucks Account No. 19

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 27,100

31 Adjusting 26 4,000 31,100

Account: Accounts Payable Account No. 21

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 4,500

Account: Wages Payable Account No. 22

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Adjusting 26 900 900

Account: Jeanne McQuay, Capital Account No. 31

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 126,400

31 Closing 27 46,150 172,550

31 Closing 27 3,000 169,550

Account: Jeanne McQuay, Drawing Account No. 32

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 3,000

31 Closing 27 3,000 — —

Account: Income Summary Account No. 33

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Closing 27 155,000 155,000

31 Closing 27 108,850 46,150

31 Closing 27 46,150 — —

Account: Service Revenue Account No. 41

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 155,000

31 Closing 27 155,000 — —

Account: Wages Expense Account No. 51

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 72,000

31 Adjusting 26 900 72,900

31 Closing 27 72,900 — —

Account: Rent Expense Account No. 52

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 7,600

31 Closing 27 7,600 — —

Account: Truck Expense Account No. 53

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 5,350

31 Closing 27 5,350 — —

Account: Depreciation Expense—Equipment Account No. 54

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Adjusting 26 5,250 5,250

31 Closing 27 5,250 — —

Account: Supplies Expense Account No. 55

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Adjusting 26 5,150 5,150

31 Closing 27 5,150 — —

Account: Depreciation Expense—Trucks Account No. 56

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Adjusting 26 4,000 4,000

31 Closing 27 4,000 — —

Account: Insurance Expense Account No. 57

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Adjusting 26 3,150 3,150

31 Closing 27 3,150 — —

Account: Miscellaneous Expense Account No. 59

Date Item

Post.

Ref. Debit Credit

Balance

Debit Credit

2014

Jan. 31 Balance √ 5,450

31 Closing 27 5,450 — —

2. Optional (Appendix)

RECESSIVE INTERIORS

End-of-Period Spreadsheet (Work Sheet)

For the Year Ended January 31, 2014

Account Title

Unadjusted

Trial Balance Adjustments

Adjusted

Trial Balance

Income

Statement

Balance

Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash 13,100 13,100 13,100

Supplies 8,000 (a) 5,150 2,850 2,850

Prepaid Insurance 7,500 (b) 3,150 4,350 4,350

Equipment 113,000 113,000 113,000

Accum. Depr.—Equipment 12,000 (c) 5,250 17,250 17,250

Trucks 90,000 90,000 90,000

Accum. Depr.—Trucks 27,100 (d) 4,000 31,100 31,100

Accounts Payable 4,500 4,500 4,500

Wages Payable (e) 900 900 900

Jeanne McQuay, Capital 126,400 126,400 126,400

Jeanne McQuay, Drawing 3,000 3,000 3,000

Service Revenue 155,000 155,000 155,000

Wages Expense 72,000 (e) 900 72,900 72,900

Rent Expense 7,600 7,600 7,600

Truck Expense 5,350 5,350 5,350

Depr. Exp.—Equipment (c) 5,250 5,250 5,250

Supplies Expense (a) 5,150 5,150 5,150

Depr. Exp.—Trucks (d) 4,000 4,000 4,000

Insurance Expense (b) 3,150 3,150 3,150

Miscellaneous Expense 5,450 5,450 5,450

325,000 325,000 18,450 18,450 335,150 335,150 108,850 155,000 226,300 180,150

Net income 46,150 46,150

155,000 155,000 226,300 226,300

3. JOURNAL Page 26

Date

Post.

Ref. Debit Credit

2014 Adjusting Entries

Jan. 31 Supplies Expense 55 5,150

Supplies 13 5,150

Supplies used ($8,000 – $2,850).

31 Insurance Expense 57 3,150

Prepaid Insurance 14 3,150

Insurance expired.

31 Depreciation Expense—Equipment 54 5,250

Accumulated Depr.—Equipment 17 5,250

Equipment depreciation.

31 Depreciation Expense—Trucks 56 4,000

Accumulated Depr.—Trucks 19 4,000

Truck depreciation.

31 Wages Expense 51 900

Wages Payable 22 900

Accrued wages.

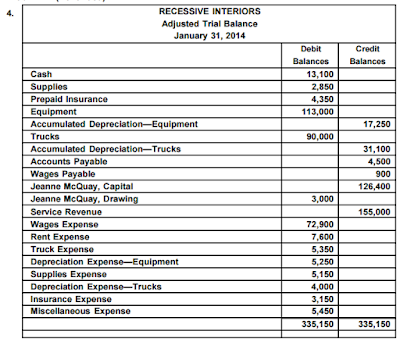

RECESSIVE INTERIORS

Adjusted Trial Balance

January 31, 2014

Debit

Balances

Credit

Balances

Cash 13,100

Supplies 2,850

Prepaid Insurance 4,350

Equipment 113,000

Accumulated Depreciation—Equipment 17,250

Trucks 90,000

Accumulated Depreciation—Trucks 31,100

Accounts Payable 4,500

Wages Payable 900

Jeanne McQuay, Capital 126,400

Jeanne McQuay, Drawing 3,000

Service Revenue 155,000

Wages Expense 72,900

Rent Expense 7,600

Truck Expense 5,350

Depreciation Expense—Equipment 5,250

Supplies Expense 5,150

Depreciation Expense—Trucks 4,000

Insurance Expense 3,150

Miscellaneous Expense 5,450

335,150 335,150

5. RECESSIVE INTERIORS

Income Statement

For the Year Ended January 31, 2014

Service revenue $155,000

Expenses:

Wages expense $72,900

Rent expense 7,600

Truck expense 5,350

Depreciation expense—equipment 5,250

Supplies expense 5,150

Depreciation expense—trucks 4,000

Insurance expense 3,150

Miscellaneous expense 5,450

Total expenses 108,850

Net income $ 46,150

RECESSIVE INTERIORS

Statement of Owner’s Equity

For the Year Ended January 31, 2014

Jeanne McQuay, capital, February 1, 2013 $126,400

Net income for the year $46,150

Less withdrawals 3,000

Increase in owner’s equity 43,150

Jeanne McQuay, capital, January 31, 2014 $169,550

RECESSIVE INTERIORS

Balance Sheet

January 31, 2014

Assets Liabilities

Current assets: Current liabilities:

Cash $13,100 Accounts payable $4,500

Supplies 2,850 Wages payable 900

Prepaid insurance 4,350 Total liabilities $ 5,400

Total current assets $ 20,300

Property, plant, and equipment:

Equipment $113,000 Owner’s Equity

Less accum. depreciation 17,250 $95,750 Jeanne McQuay, capital 169,550

Trucks $ 90,000

Less accum. depreciation 31,100 58,900

Total property, plant, and

equipment 154,650 Total liabilities and owner’s

Total assets $174,950 equity $174,950

6. JOURNAL Page 27

Date

Post.

Ref. Debit Credit

2014 Closing Entries

Jan. 31 Service Revenue 41 155,000

Income Summary 33 155,000

31 Income Summary 33 108,850

Wages Expense 51 72,900

Rent Expense 52 7,600

Truck Expense 53 5,350

Depreciation Expense—Equipment 54 5,250

Supplies Expense 55 5,150

Depreciation Expense—Trucks 56 4,000

Insurance Expense 57 3,150

Miscellaneous Expense 59 5,450

31 Income Summary 33 46,150

Jeanne McQuay, Capital 31 46,150

31 Jeanne McQuay, Capital 31 3,000

Jeanne McQuay, Drawing 32 3,000

RECESSIVE INTERIORS

Post-Closing Trial Balance

January 31, 2014

Debit

Balances

Credit

Balances

Cash 13,100

Supplies 2,850

Prepaid Insurance 4,350

Equipment 113,000

Accumulated Depreciation—Equipment 17,250

Trucks 90,000

Accumulated Depreciation—Trucks 31,100

Accounts Payable 4,500

Wages Payable 900

Jeanne McQuay, Capital 169,550

223,300 223,300