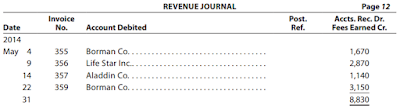

Revenue Journal Page 12

Date

Invoice

No. Account Debited

Post.

Ref.

Accts. Rec. Dr.

Fees Earned Cr.

2014

May 4 355 Borman Co. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,670

9 356 Life Star Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,870

14 357 Aladdin Co. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,140

22 359 Borman Co. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,150

31 8,830

a. Prepare a T account for the accounts receivable customer accounts.

b. Post the transactions from the revenue journal to the customer accounts, and determine their ending balances.

c. Prepare T accounts for the accounts receivable and fees earned accounts. Post control totals to the two accounts, and determine the ending balances.

d. Prepare a schedule of the customer account balances to verify the equality of the sum of the customer account balances and the accounts receivable controlling account balance.

e. How might a computerized system differ from a revenue journal in recording revenue transactions?

Answer:

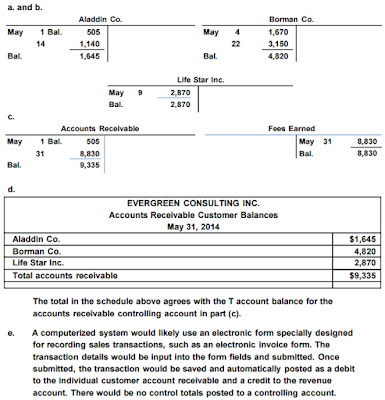

a. and b.

Aladdin Co. Borman Co.

May 1 Bal. 505 May 4 1,670

14 1,140 22 3,150

Bal. 1,645 Bal. 4,820

Life Star Inc.

May 9 2,870

Bal. 2,870

c.

Accounts Receivable Fees Earned

May 1 Bal. 505 May 31 8,830

31 8,830 Bal. 8,830

Bal. 9,335

d.

EVERGREEN CONSULTING INC.

Accounts Receivable Customer Balances

May 31, 2014

Aladdin Co. $1,645

Borman Co. 4,820

Life Star Inc. 2,870

Total accounts receivable $9,335

The total in the schedule above agrees with the T account balance for the

accounts receivable controlling account in part (c).

e. A computerized system would likely use an electronic form specially designed

for recording sales transactions, such as an electronic invoice form. The

transaction details would be input into the form fields and submitted. Once

submitted, the transaction would be saved and automatically posted as a debit

to the individual customer account receivable and a credit to the revenue

account. There would be no control totals posted to a controlling account